MDW Capital advises Longacre and Inuvi Group, the Firm’s 85th completion

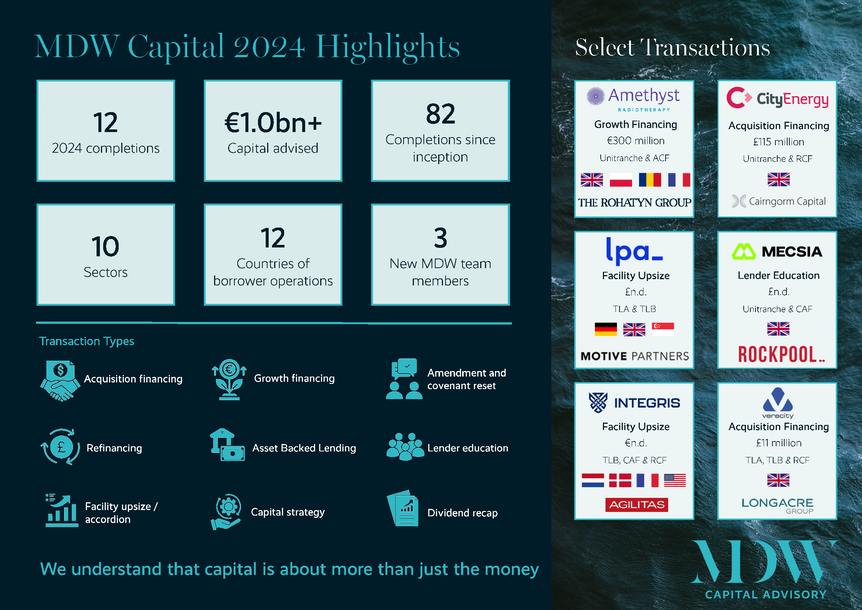

MDW Capital completes another busy year of growth

MDW Capital advises Longacre Group on raising debt facilities to support its investment in Veracity UK Limited

MDW Capital advises Amethyst Radiotherapy Group’s €300 million financing to fund its ambitious growth plans

MDW Capital supports Rockpool’s divesture of Mecsia with a Lender Education

MDW Capital appoints Jacco Brouwer as Partner

MDW Capital backs up record performance in 2023 with further investment in the team

MDW Capital advises A&M Capital Europe on raising debt facilities to support its majority acquisition of GBUK Limited

MDW Capital continues its rapid growth, announcing a further hire

MDW Capital supports Aliter Capital’s investment in Jumar

MDW Capital advises Quadrivio Group on its first UK investment

MDW Capital supports With Intelligence and Motive Partners’ Growth Investment

MDW Capital supports A&M Capital Europe’s acquisition of World of Sweets and Bobby’s (together, “IBG”)

MDW Capital advises Verso Wealth Management

MDW Capital advises E-zec Medical Transport

MDW Capital advises leading sporting goods distributor

MDW Capital continues its exceptional growth, announcing two new hires

MDW Capital advises on its 50th completion

MDW Capital advises EA-RS Group

MDW Capital is pleased to announce the completion of its latest transaction, advising EA-RS Group Limited (“EA-RS” or the “Group”) on raising over £40 million of debt facilities.

MDW Capital supports Epiris’ acquisition of Sepura

MDW Capital is pleased to announce the completion of its 48th financing in four years. The Firm has advised Epiris on arranging a €107 million debt facility to support its acquisition of Sepura, a leading provider of digital radio systems for mission-critical communications.

MDW Capital advises on its fourth completion of 2022

MDW Capital Partners LLP (“MDW”) is delighted to announce the completion of its fourth financing of 2022. MDW advised National Timber Group (“NTG”), the UK’s largest independent timber distribution and processing group, on arranging new debt facilities.

MDW Capital supports Aferian plc’s 2025 Strategy Arranging New $50 million Acquisition Facilities

MDW Capital is delighted to announce another International growth financing, closing out 2021 with its 26th completion. The Firm advised Aferian plc, the software-led global media tech company focused on TV and video streaming, in arranging new $50 million M&A growth facilities, with a further $50 million accordion facility to enable larger acquisitions to be pursued as part of the Group’s 2025 Strategy.

MDW Capital advises PHI Industrial and PPC Insulators to raise substantial acquisition and working capital credit facilities

MDW Capital (“MDW”) is delighted to announce its 25th completion of 2021, advising PHI Industrial (“PHI”) to arrange acquisition and working capital credit facilities to support its acquisition of the German group, PPC Insulators.

MDW Capital Partners LLP announces new senior hire

Leading capital advisors MDW Capital Partners LLP are delighted to announce their latest hire. John Palmer has joined the Firm as Vice President from Clydesdale Bank to support the firm’s continued growth.

MDW Capital advises on £2.5 billion in first three years

MDW Capital has celebrated its third anniversary in the style that has become the Firm’s signature: with another completion, the Firm’s 19th in 2021.

MDW Capital supports Epiris’ acquisition of Sharps Bedrooms

MDW Capital is delighted to announce the exchange of contracts by Epiris to acquire Sharps Bedrooms.

MDW Capital advises Gü on debt for sale to Exponent

MDW Capital is pleased to announce its 12th completion of 2021. The Firm advised Gü, the market leading premium chilled deserts brand, leading the lender education process for its sale by Noble Foods to Exponent.

MDW Capital advises US Sponsor Opengate Capital on the $55.2 million cross border financing of Verdant Specialty Solutions

MDW Capital is pleased to announce its 11th completion of 2021. The Firm has advised the US sponsor, OpenGate Capital Management, LLC, (“OGC”), on financing OGC’s carve-out acquisition of Solvay SA’s North American and European amphoteric surfactant business, renamed Verdant Specialty Solutions (“Verdant”).

MDW Capital advises Sponge Group and Aliter, its tenth completion of 2021

MDW Capital is pleased to announce the completion of another pan-European financing. The Firm has advised Sponge, a leading digital learning provider and a portfolio company of Aliter Capital, that offers training and technology solutions that solve multiple business challenges, from risk and compliance to people development and skills enhancement.

MDW Capital advises Grant & Stone on arranging £124 million of debt facilities

MDW Capital (“MDW”) is delighted to announce the completion of its second financing of 2021, advising Grant & Stone Limited (“Grant & Stone” or the “Group”) on arranging £124 million of debt facilities, provided by Ares Management Limited and Santander.

MDW Capital completes its first post-Brexit European deal

MDW Capital is delighted to announce the completion of its first deal of 2021. The firm advised YLDA S.p.A. on arranging €45 million of new debt facilities.

MDW Capital defies the CV19 crisis to complete its third deal in July

MDW Capital (“MDW”) is delighted to announce the completion of its third financing in July. MDW advised Grant & Stone, the leading builders, electrical and plumbing merchants focused on the repairs, maintenance and improvement sector and based in the Thames Valley.

MDW Capital arranges significant new acquisition financing during CV19 crisis

MDW Capital (“MDW”) is pleased to announce the completion of another European financing. MDW advised the Ardena Group, one of Europe’s leading Contract Development & Manufacturing Organisations who provides a full service offering covering chemistry and pharmaceutical development, product and…

Congratulations to Parker Building Supplies Ltd

MDW Capital Partners LLP is proud to have advised Parkers on the financing of enabling its exciting merger with Chandlers Building Supplies Limited. This is the latest in a series of transactions undertaken by the Company that demonstrate the importance of structuring the right financing facility at the outset to enable further acquisitions to be completed with speed and certainty

MDW Capital advises Millbrook Healthcare on its refinancing

MDW Capital is delighted to announce that it has completed another innovative financing, its fourth new funding and eighth completion of 2019. The firm advised Millbrook Healthcare on arranging new debt facilities that provide significant flexibility and funding for growth.

AgriBriefing completes buyout with capital advice from MDW Capital

AgriBriefing, the specialist business information company covering the global agribusiness supply chain, has completed a buyout of the company, led by Management in partnership with Ares Management Corporation (NYSE: ARES) and existing partner Horizon Capital…

MDW Capital supports Cairngorm Capital Partners LLP on their latest acquisition

MDW Capital Partners LLP (“MDW Capital”) is delighted to announce that it has advised Parker Building Supplies (“Parkers”), a portfolio company of Cairngorm Capital Partners (“Cairngorm Capital”), on its acquisition of Sussex Turnery & Moulding (“Stamco”).

MDW Capital completes its first deal!

It’s an innovative one: we’ve advised a German PE-backed business raising a HoldCo loan that will help it ensure it can deliver its ambitious growth plans while also structuring the deal so that existing lenders keep all their existing protections.